(770) 344-0172

(770) 344-0172

Aug 04, 2022

A comprehensive financial plan often includes an insurance and risk management analysis. The purpose of this analysis is meant to help define lifestyle expectations in the event of your (or your spouse’s) death and whether there are adequate resources to meet your family’s future needs. Below is an outline of things to know when considering life insurance policies.

Note: At Narwhal, we do not provide life insurance policies themselves, but we can make recommendations on coverage, types, and help you prepare to meet with an insurance agent.

Amount of Coverage:

You may be familiar with certain ‘rules of thumb’ when it comes to determining the appropriate amount of life insurance. This can be misleading and inaccurate because these rules of thumb can fail to accommodate unique situations or expectations. Determining the proper amount of insurance coverage is often part science and part art.

One way that we evaluate life insurance coverage amounts is using the needs approach technique. What does your family need to survive without its primary source of income? This approach to estimating your insurance needs focuses on satisfying the basic financial obligations and needs of the family.

Consider the following questions when determining amount of coverage:

Type of Coverage:

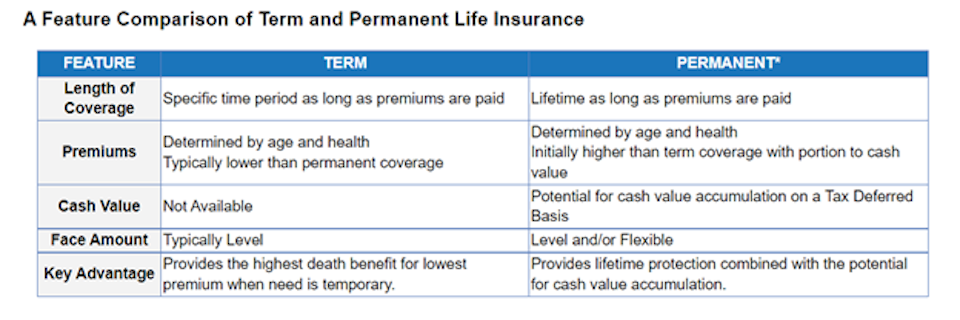

The same goes for the type of coverage. Term policies may be appropriate for some clients, while permanent coverage might be a necessity or provide additional advantages. Below are some popular types of life insurance.

Term Insurance: Term life provides coverage on the insured for a specified period of time (5,10, or 20 years) as long as the premiums are paid, and the policy is not cancelled.

Permanent Insurance: Permanent life provides coverage for the insured’s entire life, as long as premiums are paid on time and the policy is not canceled, and they generally allow for a build up of cash value. The most common types are:

Whole life: the oldest kind. Premiums are fixed and guaranteed and remain level throughout the policy’s lifetime. If premiums are paid on time, this coverage also provides a guaranteed cash value and guaranteed death benefits.

Universal: Allows the owner after the initial payment to pay flexible premiums. The owner may change the death benefits from time to time and vary the amount and timing of premium payments subject to certain minimums and standards.

Variable Universal: Combines premium and death benefit flexibility with allowing the policy owner to choose among different investment options. Values fluctuate based on market volatility.

Below is a chart that summarizes the different features between Term and Permanent

Figure 1

Financial Planning Associate

Melissa came to Narwhal in the summer of 2018 following the completion of her master’s degree in financial planning from the University of Georgia, where she also earned her bachelor’s degree in consumer economics. Her interest in the field started with learning about consumer behavior, specifically its relation with complex moneymaking decisions. Melissa recently received her CFP® Certification in January 2021. Working with a CFP® professional can help you find the path to achieving your financial goals. Your goals may evolve over the years as a result of shifts in your lifestyle or circumstances such as an inheritance, career change, marriage, house purchase , or a growing family. Melissa is here to help you through that process. When she’s not working, Melissa enjoys cycling, cooking, and spending time with her beagle and two nieces.

At Narwhal Capital Management, you’re more than just a portfolio, and it’s not all about the numbers. Let’s start with a meeting about your needs and future goals.